About Coin Collecting

Welcome to the World of Rare Coins

Can you imagine owning a gold or silver coin dating back from the 1800’s? Coins from those early days of America were carried in the pockets of famous Americans like George Washington, Thomas Jefferson, and Abraham Lincoln and were the backbone of American commerce. But when you consider the number of coins originally minted from the 18th and 19th centuries, only a relative few have survived the passage of time.

Collectors prize those survivors as beautiful works of art, as rare antiques from yesteryear. As witnesses to America’s past, coins are truly history you can hold in your hand. The scarcer the coin, the higher the price collectors and investors are willing to pay for it. Also, the better the condition of the coin makes it even more desirable and can add tremendously to its value.

We Can Satisfy all Your Rare Coin & Currency Needs

Legacy Coins & Capital has a unique advantage over other companies. While many others try to concentrate in either retail or wholesale, Legacy Coins & Capital are established experts in both the retail and wholesale markets. Simply stated, we are just as interested in purchasing rare coins and other metals as we are in selling them. Legacy Coins & Capital is therefore able to meet the diverse needs of our customers. Our organization has the professional acumen and many years of experience in buying, selling and appraising rare coins. Legacy Coins & Capital is truly a full service firm.

Above, Clockwise from top left, Saint-Gaudens Gold Double Eagle, Barber Half Dollar,Liberty Head Gold Half Eagle, Seated Liberty Quarter, and a Type III Gold Dollar in the center.

A Rewarding Hobby

Throughout most of history, only the most affluent could pursue coin collecting as a hobby. Today, interesting and collectible coins trade in all price ranges so virtually everyone can participate in some way in this most satisfying and rewarding of hobbies. Over the years, coins struck by the U.S. Mint have been accumulated by serious rare coin collectors, museums, and individuals interested primarily in investing.

A Growing Demand for Coins

Today, there’s a strong and growing base of coin collectors in the United States. Recently, the U.S. Mint reported that over 150 million Americans were currently involved in collecting coins. Many of them first got started in 1999 with the U.S. Mint’s State Quarters program and quickly discovered the joys and excitement of coin collecting. Once introduced to the hobby, many neophyte collectors became aware of the wide range of available U.S. coins beyond quarters and their collections expanded to include pre-1964 silver coins as well as pre-1933 dated U.S. gold coins.

Tremendous Collector Appeal

People collect coins for many reasons. Some collectors only want silver dollars minted with precious ore from the famous Comstock Lode in Nevada, others only collect gold coins from the California Gold Rush days. Others seek out coins from famous 19th Century shipwrecks, the Wild West era, or coins from the Civil War. Some collectors want to collect one of each type of coin issued by the U.S. Mint. Yet others have discovered the beauty and satisfaction of collecting U.S. paper money. Finding a particular area -or areas -that interest you can add immensely to the pleasure of building your collection or portfolio.

An Affordable Hobby

1879-CC Morgan Silver struck at the frontier Carson City Mint in Nevada.

Some coins are so rare that they are among the finest known to exist and can sell for $100,000 or more. One exceptionally rare specimen – a 1933 Saint-Gaudens $20 Gold Double Eagle in Gem BU condition – sold at a joint Sotheby’s and Stack’s Auction in New York City in July 2002 for over $7 million! That would be prohibitively expensive for all but the most affluent collector or investor. Fortunately, many “better date” to relatively “scarce” gold coins are attractively priced today between $500 and $5,000. Other appealing silver and gold coins can still be found at even more affordable price ranges.

Coin Grade or State of Preservation

Grading is one of the most important factors in pricing a rare coin. Coins are graded based on the number of contact marks and amount of wear. The Sheldon scale ranks coins from a nearly worn out grade of 1 to a perfect grade of 70. While those rare coins that exist in the very highest grades are usually prohibitively expensive, you should try to acquire the best quality coins you can comfortably afford.

|

Good (G-4 to G-6) Coin will have a fully readable date. The rims may be worn down to the tops of the letters. The design of the coin will be fully outlined. |

|

Extra Fine (XF-40 to XF-45) All elements in the design are clear. Some original mint luster may be visible. The high points of the design will be slightly worn. |

|

Very Good (VG-8 to VG-10) Defined rim and full legends with all letters and numerals distinct. Some detail in the design of the coin visible. |

|

About Uncirculated (AU-50 to AU-58) Wear is evident only on the highest points of the design. There may be abundant original mint luster. |

|

Fine (F-12 to F-15) Moderate wear evident. Date is bold and all letters and legends will be clear. Major design elements will show some detail. |

|

Uncirculated (MS-60 to MS-70) Uncirculated coins exhibit no wear from general circulation. Depending on contact with other coins during or after minting, blemishes or bag marks may be present. |

|

Very Fine (VF-20 to VF-35) About two-thirds of the coin’s overall design is visible. The date, letters and major design elements are sharply defined. |

|

Proof (PR-60 to PR-70) Coins made by a special process using select highly polished blanks and dies, struck slowly and multiple times in a special press to produce high-relief features. |

Why Certified Coin Grading is Important

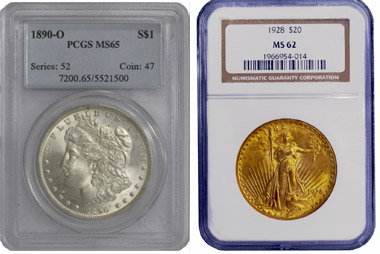

PCGS certified coin, left, and NGC certified coin, right.

PCGS certified coin, left, and NGC certified coin, right.

Instead of depending on a buyer’s or seller’s personal opinion of a coin’s grade, it can be to your advantage to acquire coins that have been certified authentic, assigned an objective grade and then sealed in a tamper-proof holder by a trusted independent grading service.

Independent audits by the Professional Numismatists Guild and the Industry Council for Tangible Assets have named both Numismatic Guarantee Corporation (NGC) and Professional Coin Grading Services (PCGS) as having set the standard for certified grading services in the rare coin industry today. Most of the highest quality coins we offer are graded by one of these two leading authorities.

So regarded are the grades assigned by these companies, rare coins can actually be traded sight-unseen by dealers over a computerized network system similar to the way the stock exchange works.

U.S. Gold & Silver Coins and Asset Appreciation

Today, many people are looking to diversify their portfolios with precious metals and hard assets. For more than 2,500 years, gold and silver have been recognized as lasting mediums of exchange. When there is the threat of a stock market crash, a currency crisis, or rising inflation creating financial risks, individuals turn to precious metals for long-term safety and protection. Clearly, hard assets have endured the test of time. They’ve proven to be the only permanent and lasting form of wealth.

One way to diversify your portfolio is through the acquisition of modern bullion coins minted in gold or silver. Another is to acquire rare United States coins minted before 1933. For many reasons, rare coins offer proven advantages over bullion alone. Rare gold and silver coins will not put you at the mercy of the precious metals market which fluctuates daily. That’s because those coins possess what is known as the “Double Play” advantage: Rare gold and silver coins can gain in value two ways thanks to their combination of intrinsic bullion value plus their numismatic rarity factor.

Rare United States Coins Offer Proven Advantages

U.S. Gold Coins Outperform Bullion

Many classic rare U.S. coins have proven to be far less speculative than bullion. The prices of gold and silver change daily on the world markets and are subject to rapid fluctuations in price. Most pre–1933 gold coins give you leverage in an aggressive gold market. A bull market in precious metals has shown to dramatically drive up demand for older gold coins and many of the older issues have enjoyed increases in value far more than that of gold bullion alone. For many collectors, buying rare coins has satisfied their desire for asset appreciation.

Compare the 10-year graph of the spot price of gold (left)

vs. the 10-year value chart of key date coins and rarities (right).

Rare Coins Have A Fixed and Limited Supply

There are further advantages to owning historic coins over modern gold bullion. Rare coins are scarce with a fixed supply while modern gold and silver coins are minted by the millions every year. A modern gold bullion coin for example, is worth exactly its weight in gold plus a small minting premium. Its value goes up and down in step with the spot price of gold bullion. Likewise, the value of modern silver bullion coins will vary according to the changing spot price of silver

On the other hand, U.S. gold coins minted before 1933 have a fixed and limited supply based on how many coins the U.S. Mint struck during the year, and it’s extremely important to realize that millions of gold and silver coins were melted down over the years. In addition, veteran collectors and investors are adding rare U.S. coins to their respective collections and portfolios daily, and additional demand is growing dramatically among the new crop of collectors further diminishing the supply of those desirable older coins.

|

|

|

|

|

|

| Type IIGold Dollar | Indian HeadQuarter Eagle | Indian Princess HeadThree Dollar Gold | Liberty HeadHalf Eagle | Indian HeadEagle | Saint-GaudensDouble Eagle |

Rare Coins Can Help Diversify Your Portfolio

Diversifying your portfolio with more than just gold or silver bullion may offer you a better long term potential for asset appreciation. Rare coins can offer you safety in an economic crisis and a way to add leverage to your gold and silver portfolio.

A comparison of the 10-year Generic Gold Coin Index (left) to the 10-year Mint State Rare Gold Coin Index (right).

Most U.S. gold coins that are rare today were minted before America’s Great Depression. In 1933 President Roosevelt’s Emergency Banking Act became law, one result being that holders of gold coin, gold bullion, and gold certificates had to surrender them to the Treasurer of the United States and to accept paper money instead. The minting of circulating U.S. gold coinage ceased.

In addition, in prior years U.S. Government Acts resulted in the melting of hundreds of millions of U.S. silver coins. The 1918 Pittman Act alone resulted in the melting of some 270 million Morgan silver dollars for their bullion content. Additional millions were melted in subsequent years, forever removing even more mint state coins from existence.

Today, from the original number of coins that were minted prior to the year 1933, it is estimated that less than 1% of them exist in Uncirculated Mint State condition, with only a small percentage of those survivors of the highest quality. Those specimens are eagerly sought-after by collectors and investors, further decreasing their availability and increasing their value.

Legacy Coins & Capital offers a diverse range of appealing coins to fit your budget and collecting needs.

Call us toll free at 800.766.2646 and speak to one of our Account Specialists today!